Summary

- To avoid budget surprises, request a status certificate, inspect for major wear, and leave a 20–30% buffer for rising fees. New developments often underquote maintenance costs, so it’s smart to compare past builds from the same developer.

- Condo maintenance fees in Toronto average around $0.64 per square foot—but can climb past $1.20 in luxury or older buildings. This translates to monthly costs of $365–$1,000+ depending on unit size, age, location, and amenities.

- These fees cover essentials like utilities, security, and upkeep, plus contributions to a reserve fund for future repairs. Still, owners may face unexpected costs through special assessments if the reserve fund falls short.

You’re eyeing that new development on Lakeshore. One-bedroom condos are going for $650,000 — a little less than the latest average of $720,000.

So you map out your mortgage and figure your income matches the monthly payments. Or, you consider a potential rental price to use it as an investment.

Have you factored in an average of $500-$1,000 for monthly maintenance fees? Oh yes. Maintenance fees are the gift that keeps on giving. We all love clean pools and working elevators, so make sure you consider maintenance fees when you’re shopping around.

We’ll walk you through the ins and outs of maintenance fees, including why they’re a thing, what they cover, and why they can be so high in Toronto.

What are condo maintenance fees?

Condo maintenance fees are monthly payments every condo owner is responsible for. Before you raise hands, consider that houses come with monthly upkeep responsibilities as well, from plumbing and hydro to gas and roof repairs.

Most condo maintenance fees cover utilities like heat (gas), air conditioning, water, and sometimes even hydro. Consider a condo’s amenities as well — the pool and 24/7 concierge aren’t “perks” as much as services that your maintenance fees buy and pay for.

Here’s a list of potential items covered in condo maintenance fees:

- Cleaning services for common areas

- Party room upkeep

- Pool and hot-tub maintenance

- Security salaries

- 24/7 concierge salaries

- Waste management

- Landscaping

Many condo maintenance fees also go toward the reserve fund. This fund is dedicated to repairing bigger condo issues that could arise in the future. Still, reserve funds aren’t a foolproof strategy. It’s not uncommon to see condo owners slapped with repair fees of tens of thousands of dollars in one shot — after all, it’s in the contract.

Now, let’s talk numbers.

How much are condo maintenance fees?

The truth is that maintenance fees vary, with older builds usually having higher maintenance fees because of the upkeep. Still, newer, luxury builds with endless amenities can still cost more than average, too.

Condos.ca says the average cost of Toronto condo maintenance fees is $0.64 per square foot.

What does that look like per month?

If you’re working with a one-bedroom condo? You’re looking at an average of 570 square feet, which translates to an average of $364.80 per month. For the 915-square-foot two bedroom? $585.60.

But anyone buying a newer condo knows all too well how low these figures look. One Toronto real estate blog points out a $948 maintenance fee on an 854-sq-foot condo. Aka, $1.10 per square foot — nearly double.

You’ll need to factor in maintenance fees with your overall monthly costs, like mortgage and interest rates.

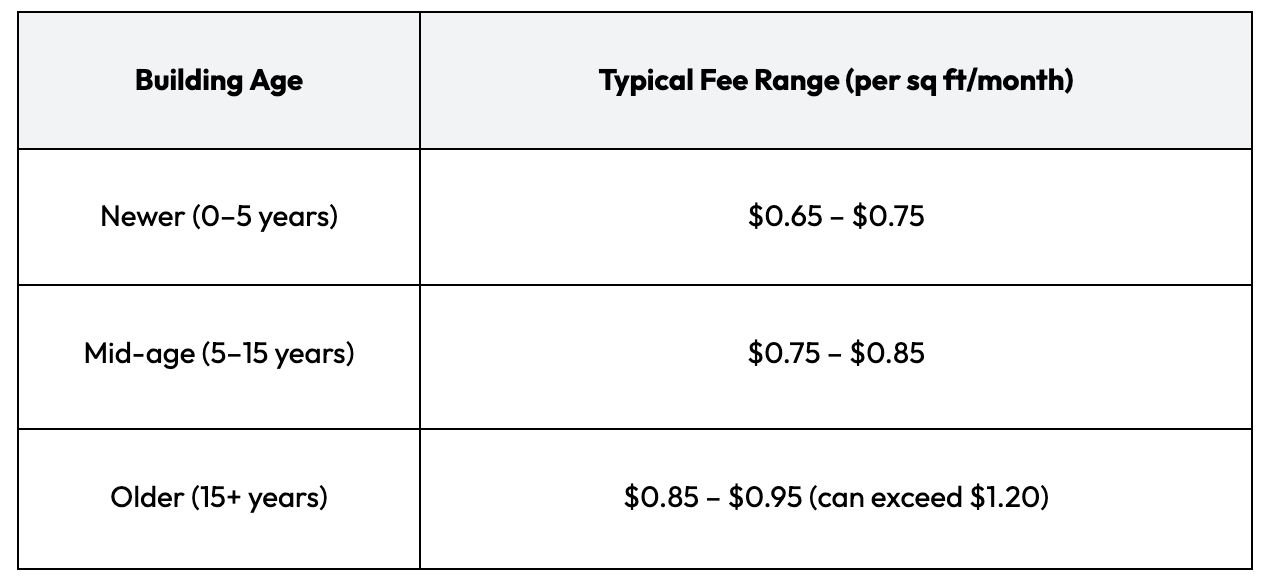

Here's a deeper look at how fees can vary by building age, type, and neighbourhood:

Fee ranges by building age

Fee variations by neighbourhood and building type

Downtown Core (Entertainment District, Waterfront, Yorkville):

- Fees are often on the higher end due to premium amenities, higher staffing costs, and older infrastructure in some buildings.

- Luxury buildings (e.g., 33 Harbour Square, Shangri-La) can have monthly maintenance fees for a one-bedroom unit exceeding $1,000.

- Newer downtown condos may start at $0.60–$0.75 per sq ft, but older or amenity-rich buildings can reach $1.20–$1.50 per sq ft.

Midtown and Uptown:

- Generally see fees in the $0.70–$0.90 per sq ft range for mid-age buildings.

- Older buildings, especially those with extensive amenities, can approach or exceed $1.00 per sq ft.

Suburban and Outer Neighbourhoods:

- Lower fees are more common, especially in older, less centrally located buildings.

- Median monthly fees for a one-bedroom unit can be as low as $533, compared to over $1,000 in some central locations.

Luxury and Boutique Buildings:

- Fees are typically higher due to fewer units sharing costs and a greater number of amenities.

- Boutique condos may have slightly above-average fees, sometimes $0.90–$1.20 per sq ft.

Tips for Minimizing Maintenance Fees

Most of the time, you can’t negotiate your way out of paying maintenance fees. It’s as fixed a cost as your mortgage or car payments. But you can take some steps before buying to find builds with cheaper fees.

1. Shop around

Condo fees vary. Take your time looking at different developments and look at what maintenance fees cover in each one. Maybe you’re not interested in amenities like a pool and would happily buy a condo without the frills aka lower maintenance fees.

Always ask for a status certificate from the condo corporation. This document tells you exactly what maintenance fees cost and what they cover. One condo lawyer advises Toronto Star readers to examine the status certificate for other financial information like:

- Situations that could heighten condo expenses

- Previous special assessments

- Previous increases

Now, what if you’re looking at pre-constructions? Unfortunately, pre-con contracts don’t always promise a set amount for maintenance fees. Even if you push hard to try and get a number from them, they can keep things vague and leave you surprised. In this case, you might look at previous builds from the same developer for ideas.

2. Look for obvious issues

Maintenance fees are a set fee each month, but you could pay more at any given time if a big repair is needed. Are you considering a super old building that’s barely standing? The purchase price might be reasonable, but you could expect a huge maintenance fee to fix big-ticket items like water damage and other issues.

3. Leave wiggle room in your budget

Some condo developers underquote maintenance fees. New owners have taken possession of condos with an estimated 10 - 30 percent higher maintenance fee than expected. You should also look closely at insurance policies for condos before taking the plunge, since deductibles and premiums have increased in the past few years.

If you’re conservative in your financial estimates, you’ll better prepare for your investment. Adding an extra 20% in wiggle room might not make your condo as “worth it” as you thought, especially with other home expenses. So you could seek a different property altogether.

Budget wisely before buying in Toronto

Let's recap some of our takeaways:

- Condo maintenance fees in Toronto average around $0.64 per square foot—but can climb past $1.20 in luxury or older buildings. This translates to monthly costs of $365–$1,000+ depending on unit size, age, location, and amenities.

- These fees cover essentials like utilities, security, and upkeep, plus contributions to a reserve fund for future repairs. Still, owners may face unexpected costs through special assessments if the reserve fund falls short.

- To avoid budget surprises, request a status certificate, inspect for major wear, and leave a 20–30% buffer for rising fees. New developments often underquote maintenance costs, so it’s smart to compare past builds from the same developer.

Toronto is one of the best cities in the world, but it can certainly put some pressure on your wallet. However, some smart budgeting and planning can help you navigate the high costs of living in the city.

Frequently asked questions

What are typical closing costs on a condo in Toronto?

Closing costs in Toronto can vary, but typically they range from 1.5% to 4% of the purchase price. This includes taxes, land transfer fees, lawyer fees, and other administrative costs.

What fees do you pay in a condo?

As a condo owner, you will be responsible for paying monthly maintenance fees to cover building amenities and common areas. These fees can vary depending on the size of your unit and the amenities offered by your building.

Are condo fees worth it?

Many people wonder if condo fees are worth the cost. It's important to remember that these fees cover maintenance and repairs for shared spaces, such as lobbies, hallways, elevators, and amenities like pools or fitness centers. They also often include utilities like water and electricity. Overall, condo fees can save you money compared to owning a house where all of these costs would be your responsibility.